By: Cline Agency Insurance Brokers

Today we find ourselves inundated with facts and opinions all over the newswire. While it may be tempting to stick our head in the sand, there is one takeaway that we can take comfort in, the all-important and timeless life lesson:

“an ounce of prevention is worth a pound of cure”

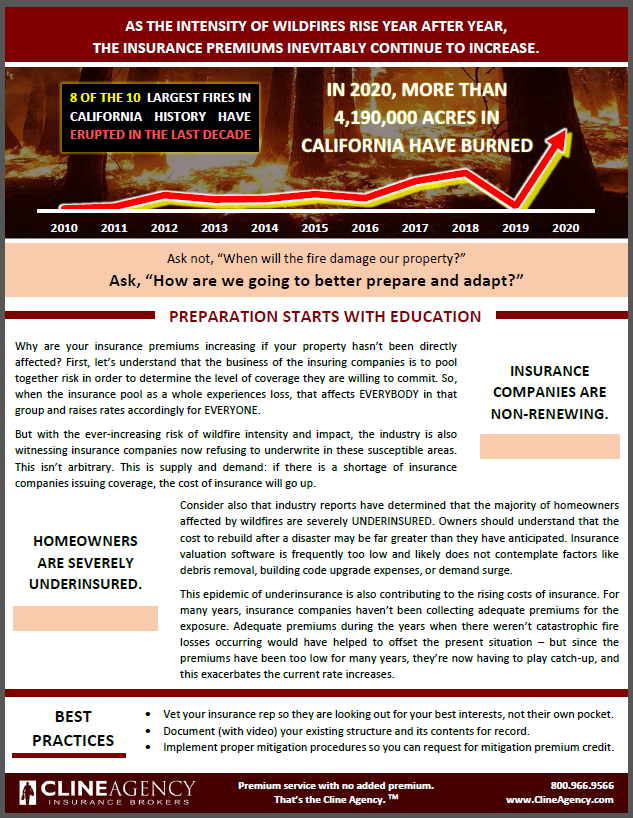

There’s a growing frustration among California homeowners over the worsening insurance pricing and availability. And the data shows that the top 10 costliest wildfires have all occurred in California, most in the last decade:

|

Top 10 Costliest Wildland Fires in the United States (1) (1) Includes losses sustained by private insurers and government-sponsored programs such as the National Flood Insurance Program. Includes events that occurred through 2020. All fires on this list occurred in California. Includes Puerto Rico and the U.S. Virgin Islands. Ranked on losses in 2020 dollars. Subject to change as loss estimates are further developed. As of February 23, 2021. Source: Aon |

Maybe now you’re looking for that ounce of prevention?

Well naturally, it starts with education. And we believe there are 2 key issues to zero in on:

- Insurance companies are non-renewing.

- Homeowners are severely underinsured.

Each of these present unique issues and so we’ve compiled the following 1-page guide to dive further into these topics. We hope you find this useful to review, and feel free to share with others so that we can help get everyone on the same page.

NEXT STEPS: Lets get with our fellow association board members and managers, and help establish a plan to implement some initial wildfire risk management measures for our buildings. Be sure to check out CalFire’s website www.readyforwildfire.org for their great resource library, including instructional videos on fire hardening checklists and procedures.

|

* IMPORTANT NOTE * |

If you find this content helpful, please consider retweeting it.

(CLICK HERE TO OPEN)

(CLICK HERE TO OPEN)